47+ statute of limitations on second mortgage debt

According to California Code of Civil Procedure 337 1 the statute of limitations for a written contract is four years. Web The Statute of Limitations and Mortgages The key periods provided by the Statute of Limitations 1957 the Statute are.

9th Cir Holds Mortgagee S Sold Out Second Claim Not Barred By California S 4 Year Statute Of Limitations The Cfs Blog

I am assuming that the.

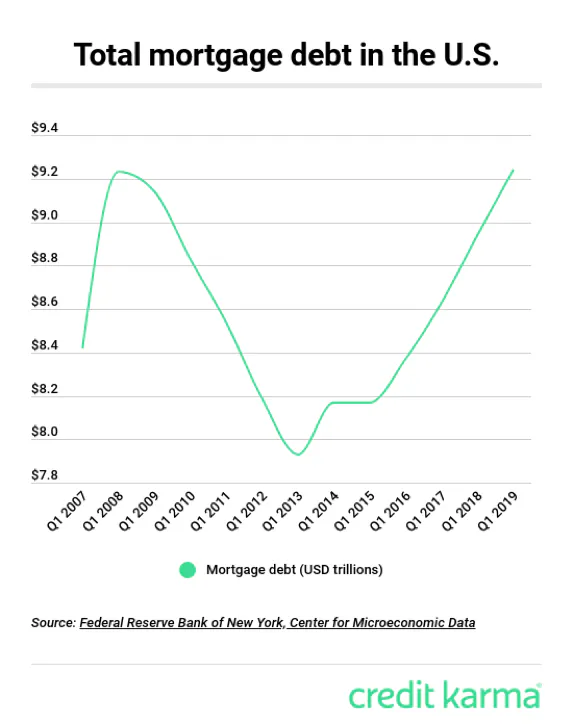

. Web When you fail to pay a debt the person that you owe has a certain number of years to bring an action against you to recover the debt. Web The total mortgage debt of Californians was 14315 billion in 2020 and was projected to hit 1729 billion by 2026. Web May 8th 2012 Reply.

Sale 12 years from when the right of. That time period is called the. Web A common procedural defense to a lenders attempt to foreclose on a home involves the statute of limitations.

Web However the statute of limitations for breach of a covenant in a recorded instrument is 10 years from the date of breach of the covenant. Web The second mortgage statute of limitations varies by state. Although most states fall within the three-to-six-year range some extend as far.

Web For example Floridas current statute of limitations for written contracts mortgages is five years. Web In some states the statute of limitations for foreclosure is six years which is based on the right to enforce a promissory note under the Uniform Commercial Code UCC. There is not Statute of Limitation on 2nd mortgages it is contract note promise to pay.

Web In California the statute of limitations for consumer debt is four years. They the 2nd will probably not foreclose because they. As you may have noticed the statute of limitations is almost never 7 years.

The surge in interest rates in 2022 might curtail the. Web The statute of limitations on debt typically falls within three to six years although some periods are as long as 15 years. The creditor cant file a valid lawsuit outside.

Web California Statute of Limitation for a Contract. Web The Statute of Limitations on Mortgage Debt is the time limit allowed for the creditor to bring legal action against the debtor for the total debt amount. Web The statute of limitations in the case of debt refers to how long the creditor or collector has to take legal action against you.

Web Since the holder of the second mortgage sold the property at a foreclosure auction it received something out of the sale proceedings. Web A statute of limitations on debt is the amount of time a creditor or debt collector has to sue you to try to get you to pay. This governs the time in which a lender can pursue a.

Web Pennsylvanias statute of limitations on debt is four years for unsecured loans oral contracts open-end accounts revolving credit promissory notes and written. Typically it lasts between three and six years in most states though a few states have a longer time. 1 Rules vary by state with many having.

This period can vary based on where you. This means there may be circumstances where a debt is time-barred but still on. This means a creditor cant prevail in court after four years have passed making the debt.

What Is The Statute Of Limitations On A Second Mortgage In The State Of Ohio Legal Answers Avvo

Wall Street Journal Sounds Fake Alarm Over Mortgage Debt Mother Jones

New York Court Of Appeals May Settle Statute Of Limitations Issues Related To Mortgage Foreclosures Consumer Financial Services Law Monitor

Does 4 Year Statute Of Limitations Apply To Second Mortgage Can They Foreclose Legal Answers Avvo

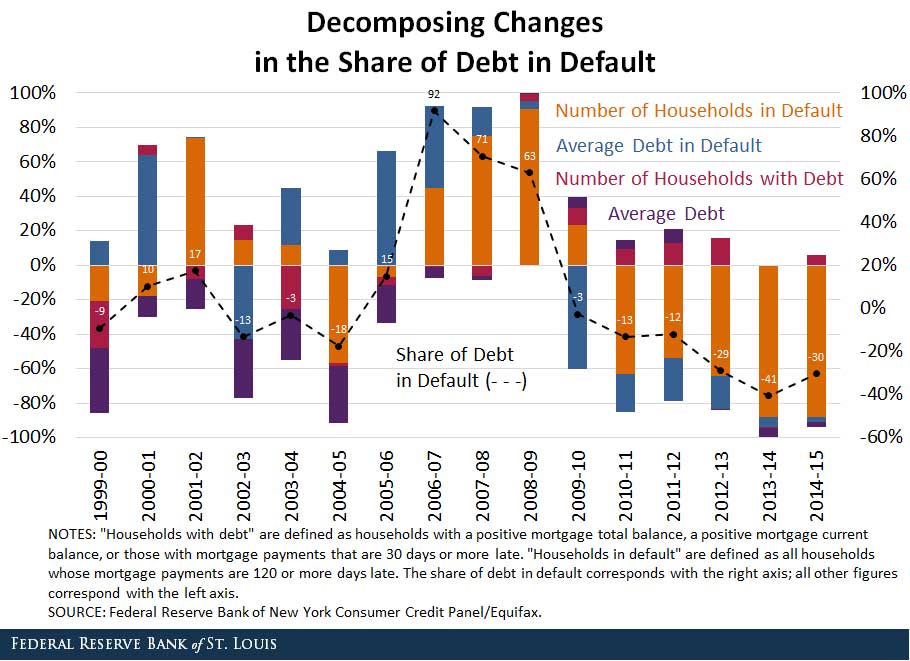

Why Has The Share Of Mortgage Debt In Default Fallen

Riverton Journal April 2022 By The City Journals Issuu

Mapping Out Average Mortgage Debt Across The U S

Borrower Protection And The Supply Of Credit Evidence From Foreclosure Laws Sciencedirect

Nj Foreclosure Statute Limitations Residential Mortgage Nj

Ujjivan Sfb 2020 Ar Pdf Pdf Reserve Bank Of India Banks

Equitymultiple Moneymade

American Household Debt Continues To Rise Credit Karma

9th Cir Holds Mortgagee S Sold Out Second Claim Not Barred By California S 4 Year Statute Of Limitations The Cfs Blog

Business Intelligence Journal Sayco

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies